Chapter 7 Vs Chapter 11 bankruptcy filings are often discussed, but understanding the nuances can be challenging. This article clarifies the key distinctions between these two processes, helping you navigate the complexities of bankruptcy law. ind vs sl live streaming

What is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy, often referred to as liquidation bankruptcy, involves the sale of a debtor’s nonexempt assets to repay creditors. It’s generally a quicker process designed for individuals and businesses with limited income and significant debt.

Advantages of Chapter 7

- Quick debt relief: Chapter 7 can discharge most unsecured debts within a few months.

- Fresh start: It offers a chance to rebuild finances after eliminating overwhelming debt.

- Relatively simple process: Compared to Chapter 11, it’s less complex and time-consuming.

Disadvantages of Chapter 7

- Loss of assets: Nonexempt assets may be sold to repay creditors.

- Impact on credit score: Filing for bankruptcy significantly affects credit rating.

- Not suitable for all debts: Some debts, like student loans and most tax debts, are not dischargeable under Chapter 7.

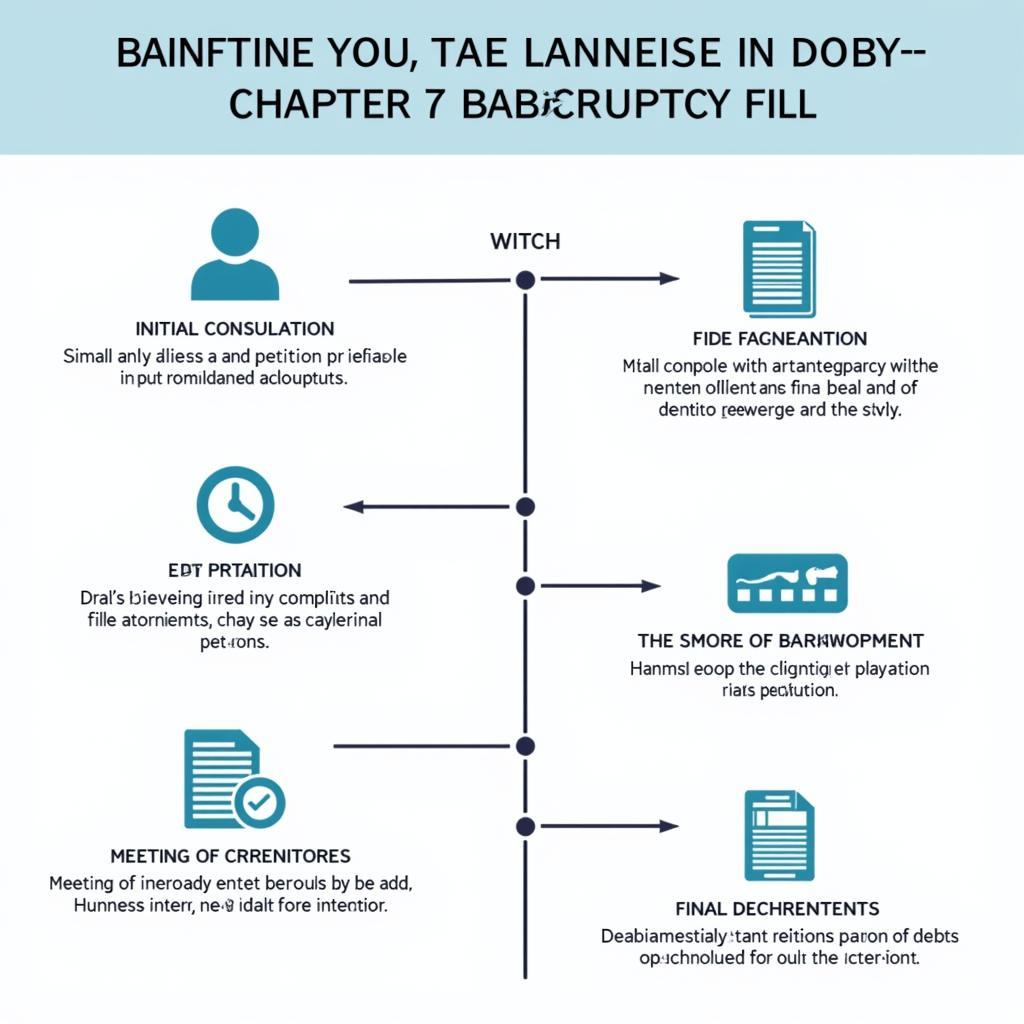

Chapter 7 Bankruptcy Process Illustration

Chapter 7 Bankruptcy Process Illustration

What is Chapter 11 Bankruptcy?

Chapter 11 bankruptcy, known as reorganization bankruptcy, allows businesses and high-net-worth individuals to restructure their debts while continuing operations. It involves developing a repayment plan approved by the court and creditors.

Advantages of Chapter 11

- Business continuity: Businesses can continue operating while reorganizing.

- Debt restructuring: It allows for negotiating more manageable repayment terms.

- Protection from creditors: Provides temporary relief from creditor actions.

Disadvantages of Chapter 11

- Complex and costly: It’s a more complicated and expensive process than Chapter 7.

- Time-consuming: Reorganization can take several years.

- Court oversight: Requires strict adherence to court-approved plans and reporting requirements.

Chapter 7 vs Chapter 11: Key Differences

The core difference between Chapter 7 and Chapter 11 lies in their purpose: liquidation versus reorganization. Chapter 7 aims to liquidate assets to pay off debts swiftly, while Chapter 11 focuses on restructuring debt to allow the debtor to continue operations. escanor vs estarossa chapter

- Eligibility: Chapter 7 is typically for individuals and businesses with limited income and high debt, while Chapter 11 is for businesses and high-net-worth individuals seeking to reorganize their finances.

- Process: Chapter 7 is a quicker, more streamlined process involving asset liquidation, while Chapter 11 is a more complex and lengthy process focusing on debt restructuring and business reorganization.

- Outcome: Chapter 7 results in debt discharge after asset liquidation, while Chapter 11 results in a court-approved reorganization plan with modified debt repayment terms.

“Choosing between Chapter 7 and Chapter 11 requires careful consideration of the debtor’s financial situation and long-term goals. Consulting with a bankruptcy attorney is crucial to determine the most appropriate course of action,” says John Smith, a leading bankruptcy lawyer at Smith & Jones Law Firm.

Which is Right for You?

Deciding between Chapter 7 vs Chapter 11 requires professional guidance. watch real madrid vs atletico madrid Consulting with a bankruptcy attorney is essential to assess your unique circumstances and determine the most suitable option.

Conclusion

Understanding the differences between Chapter 7 and Chapter 11 is crucial for navigating the complexities of bankruptcy. While Chapter 7 provides a quicker path to debt relief through liquidation, Chapter 11 offers the opportunity for reorganization and business continuity. Choosing the correct path requires careful consideration and professional advice. ban vs meliodas

FAQ

- What is the difference between Chapter 7 and Chapter 11 bankruptcy? Chapter 7 involves liquidating assets to repay debts, while Chapter 11 focuses on reorganizing finances and continuing operations.

- Who is eligible for Chapter 7? Individuals and businesses with limited income and significant debt are typically eligible.

- Who is eligible for Chapter 11? Businesses and high-net-worth individuals seeking to reorganize their debts are generally eligible.

- How long does Chapter 7 take? A few months.

- How long does Chapter 11 take? Several years.

- Can all debts be discharged under Chapter 7? No, some debts, like student loans and certain tax debts, are typically not dischargeable.

- What is a reorganization plan in Chapter 11? A plan outlining how the debtor will repay creditors over time while continuing operations.

Khi cần hỗ trợ hãy liên hệ Số Điện Thoại: 02838172459, Email: truyenthongbongda@gmail.com Hoặc đến địa chỉ: 596 Đ. Hậu Giang, P.12, Quận 6, Hồ Chí Minh 70000, Việt Nam. Chúng tôi có đội ngũ chăm sóc khách hàng 24/7.