Amalgamation and consolidation are two terms often used interchangeably in the business world, but they represent distinct legal and financial processes. While both involve the combination of two or more entities, the resulting structure and implications differ significantly. Understanding these nuances is crucial for making informed decisions regarding mergers, acquisitions, and corporate restructuring.

Defining Amalgamation

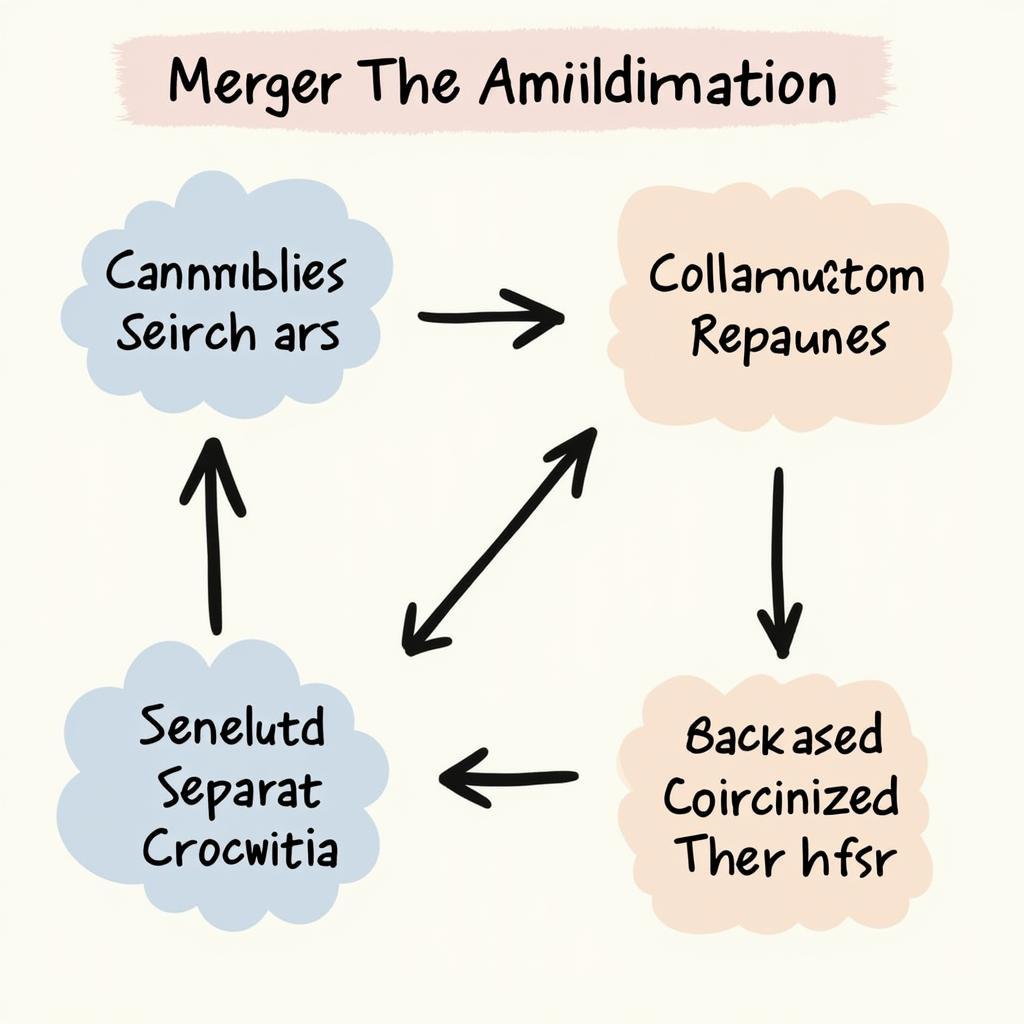

Amalgamation refers to the complete merging of two or more companies into a new entity. This process involves the dissolution of the original companies, and their assets and liabilities are transferred to the newly formed entity. Shareholders of the original companies receive shares in the amalgamated entity based on a predetermined exchange ratio.

Amalgamation Process Illustration

Amalgamation Process Illustration

A key characteristic of amalgamation is that the original companies cease to exist, and the newly formed entity assumes all rights and obligations. This process is often driven by strategic goals such as expanding market share, gaining access to new technologies, or achieving economies of scale.

Understanding Consolidation

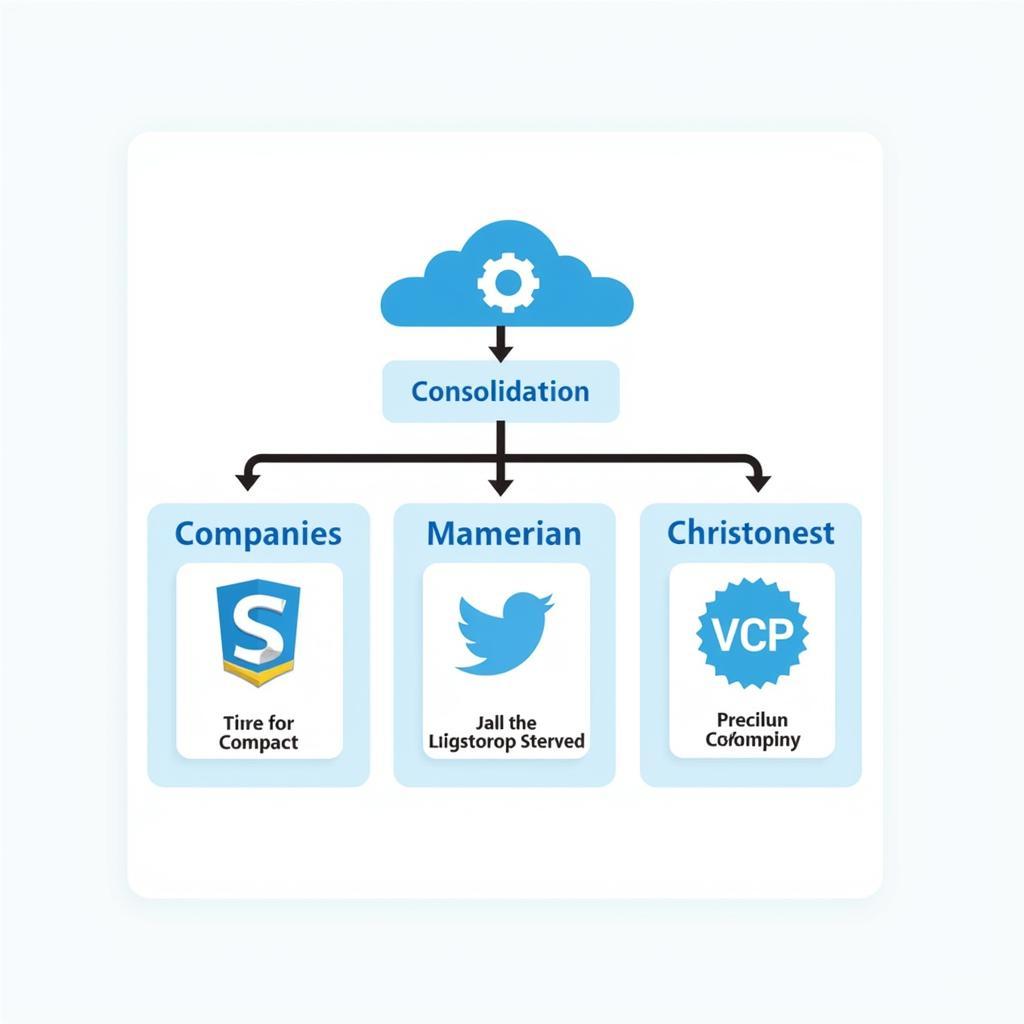

Consolidation, on the other hand, involves combining two or more existing companies into a new entity, but the original companies may or may not be dissolved. In this scenario, the new entity assumes ownership of the assets and liabilities of the consolidating companies. Shareholders of the original companies typically receive shares in the new consolidated entity.

Consolidation Structure Diagram

Consolidation Structure Diagram

Unlike amalgamation, consolidation doesn’t necessarily lead to the complete dissolution of the original companies. They may continue to operate as subsidiaries or divisions of the consolidated entity. This approach allows for greater flexibility and can be advantageous in situations where preserving brand identity or maintaining separate legal structures is desired.

Key Differences: Amalgamation vs Consolidation

The fundamental distinction between amalgamation and consolidation lies in the legal and structural outcomes. Here’s a closer look at the key differences:

1. Formation of a New Entity: Both processes involve the creation of a new entity. However, in amalgamation, the new entity is formed by dissolving the original companies. In consolidation, the new entity is created while the original companies may or may not be dissolved.

2. Dissolution of Original Companies: Amalgamation necessitates the complete dissolution of the original companies, while consolidation allows for their continued existence as subsidiaries or divisions.

3. Transfer of Assets and Liabilities: In both cases, the new entity assumes the assets and liabilities of the merging companies. However, the specific mechanism of transfer may differ based on the legal framework governing the process.

4. Shareholder Rights: Shareholders of the original companies receive shares in the new entity under both amalgamation and consolidation. However, the exchange ratio and rights attached to these shares may vary depending on the terms of the agreement.

5. Legal and Regulatory Framework: The legal and regulatory requirements for amalgamation and consolidation differ significantly based on jurisdiction and industry. It’s crucial to consult with legal and financial professionals to ensure compliance with all applicable laws and regulations.

Choosing the Right Approach: Factors to Consider

Deciding between amalgamation and consolidation depends on the specific circumstances and objectives of the companies involved. Here are some key factors to consider:

-

Strategic Goals: Define the overarching goals driving the combination, such as market expansion, diversification, or cost optimization.

-

Operational Synergies: Evaluate potential synergies in terms of operations, technology, distribution channels, and customer base.

-

Brand Equity: Consider the value of existing brands and whether preserving them is strategically important.

-

Legal and Tax Implications: Assess the legal and tax consequences of each approach, including potential liabilities and tax benefits.

-

Shareholder Value: Analyze the impact on shareholder value, considering the exchange ratio, potential dilution, and future growth prospects.

Conclusion: Making Informed Decisions

Amalgamation and consolidation are complex processes with significant legal, financial, and operational implications. Understanding the key differences between these two approaches is crucial for making informed decisions that align with strategic goals and maximize value for all stakeholders. Careful planning, due diligence, and expert guidance are essential for navigating the complexities of corporate combinations and ensuring a successful outcome.

FAQs about Amalgamation and Consolidation

1. What are the tax implications of amalgamation vs. consolidation?

Tax implications vary greatly depending on jurisdiction. Generally, amalgamations may offer more tax benefits due to the complete dissolution of original companies.

2. Can a private company amalgamate with a public company?

Yes, but the process is typically more complex, often involving the private company going public or the public company taking the private company private.

3. What happens to employee contracts during an amalgamation or consolidation?

Typically, employee contracts are absorbed by the new entity, but specifics depend on local labor laws and agreements negotiated during the process.

4. How long does an amalgamation or consolidation take to complete?

The timeframe varies greatly depending on the complexity of the transaction, regulatory approvals needed, and due diligence required. It can take anywhere from several months to over a year.

5. Where can I find more information on specific legal requirements for my jurisdiction?

Consult with legal professionals specializing in mergers and acquisitions in your specific region. They can provide tailored advice based on local laws and regulations.

Need Help with Your Corporate Strategy?

For expert guidance on amalgamation, consolidation, or any corporate strategy matter, contact us:

Phone: 02838172459

Email: [email protected]

Address: 596 Đ. Hậu Giang, P.12, Quận 6, Hồ Chí Minh 70000, Việt Nam

Our team is available 24/7 to answer your questions and provide comprehensive support.